Made to measure: Matching thought leadership typology with commercial objectives

Joe Dalton

When a company embarks on a thought leadership project, the very first thing it must establish – well before considering the topic, or scope of the work – is what its top marketing objectives are.

Good thought leadership can serve a brand or marketing campaign in many different ways. To name just a few, it can: enhance a brand’s profile; support lead generation; deliver press and media coverage; be an effective conversation starter for sales; serve as the key input and rationale for a custom event; or provide carefully targeted content to associate your products and services with specific search terms.

Of course, marketers typically want to hit all of these objectives, and more, but different thought leadership types are better placed than others to help deliver on certain types of outcomes. Without crystallising where you want your thought leadership to take you, you will struggle to identify the typology that you need, and to execute it effectively. This makes a clear grasp of your objectives absolutely vital. As with a car that tries to be all things to all people, it too easily ends up being weak across all areas.

So what are some of the possible options you might consider?

An industry outlook – The state of the nation report

Compiling annual outlook reports that assess the health, relative confidence, and key trends within an industry can be a very effective means for a company to position itself as an authoritative commentator within the sector. Over time, if repeated consistently, it also helps to develop a specific brand or reputation in a given area.

Conducting in-depth research each year not only creates the valuable industry insights you need, but also positions your brand as a key industry player, often while developing an actual brand name in that domain. During the 90s and 00s, IBM effectively “owned” the e-readiness rankings, through its ongoing efforts to rank countries. Of course, such results are also very press-friendly, and can build up over time too.

As one example, DNV GL, a provider of technical assurance, advisory and risk management services to the oil and gas industry, has created its own annual industry outlook report. It has seen the traction of its research grow dramatically year-on-year and the reports have enabled it to bolster its brand and reputation within the global oil and gas industry.

CXO reviews – The changing role of a key function

Other types of studies are designed for supporting targeted relationship building. For example, a deep analysis of the trends that are shaping a specific executive role can reveal shifts in the way that particular functions are evolving, in response to the demands of the industry and wider business environment.

Such studies make very engaging reading for those building careers in these areas and they speak directly to the concerns and interests of the C-suite executives they target. Accordingly, they can be a powerful tool for relationship building with executives in different branches of organisations. One such example is EY’s ongoing efforts to detail insights for CFOs, CIOs, COOs and others. These studies, such as The DNA of the CFO (and CIO), provide in-depth insights into the personal agenda of these executives – and help open the door to setting up meetings with them.

Benchmark studies – How do you compare?

In the right context, benchmark studies are an excellent means of extending the shelf-life of a piece of research, while providing a content-led approach for generating additional opt-in leads from respondents.

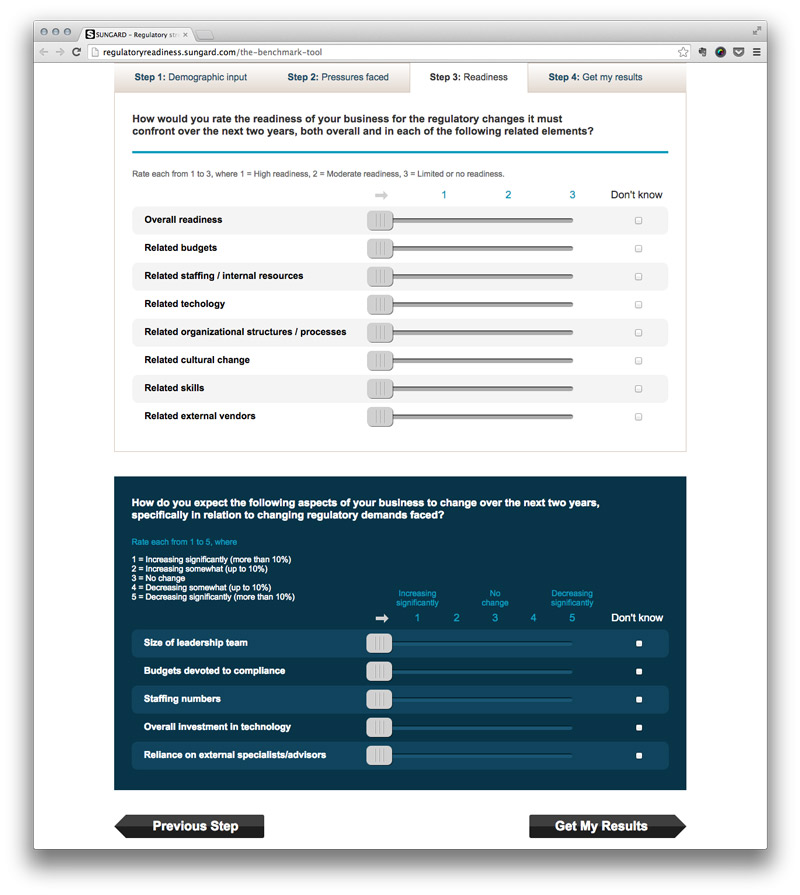

For example, IT services company SunGard created an interactive benchmarking tool from its research into the regulatory stresses being experienced by the global financial services industry. The tool allows respondents to assess the degree of stress their organisation is feeling and its state of readiness for the changes that lie ahead, comparing with peers by industry, geography and organisation. Not only did the company gain substantial press attention for the research, but this also paved the way for drumming up a host of new business leads. See Simmons & Simmons’ Big Data Race for a more up-to-date example.

The three examples above highlight the results that can be achieved when a company successfully aligns its commercial objectives with the right thought leadership typology. Of course, these three types are just the tip of the iceberg, but it hopefully makes the principle clear. We’d love to discuss this further if you’d like to learn more.

Explore our guide to developing your thought leadership strategy for your go-to resource for on planing, developing and executing a strategy.

Speak to the team

We’ll help you to navigate and overcome any challenges you currently face and learn how to get more out of your content.

Book a meeting